Want to pick up some FTSE 250 stocks with promising dividends for your Isa? These 12 shares could be worth a look

Mid-sized firms that slashed dividends but are expected to grow them by more than 10 per cent this year and next are revealed in new research from wealth manager Canaccord Genuity.

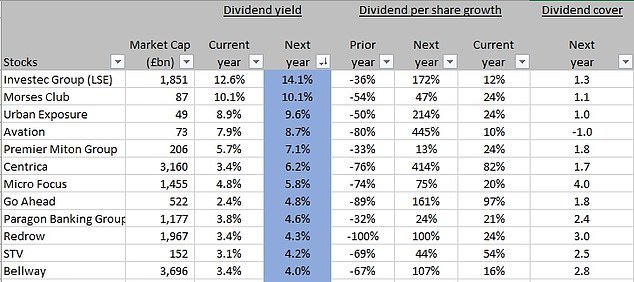

The 12 firms, all predicted to yield more than 4 per cent in 2022 based on consensus forecasts by City analysts, are dominated by financial, housebuilder and travel stocks.

The FTSE 250-listed broker Investec, with a forecast yield of 14 per cent next year, doorstep lender Morses Club and aircraft leasing company firm Avation top the list.

They are accompanied by an AIM-listed firm with similar potential, the development finance specialist Urban Exposure.

Income payers: FTSE 250 stocks with promising dividends for your Isa revealed

‘As vaccine programmes signal the world has maybe regained some control in the fight against coronavirus, we see markets begin to stabilise.

‘And with that, we see green shoots of optimism with dividend reinstatement in the FTSE 250,’ says Simon McGarry, senior equity analyst at Canaccord.

‘Due to the fact that so many companies cut their dividend last year, common sense might indicate that several should reinstate their dividend in 2021 and possibly grow them in 2022.’

McGarry, who looks more closely at companies that could see their dividends bounce back strongly below, says that 2020 was a terrible year for income investors, who rely on dividend payouts.

‘Dividends were cancelled, left, right and centre. All sectors were hit, including bellwether income sectors like oil and gas, banks and tobacco.

‘In the first six months of 2020, we counted 260 UK companies that had cut their dividend’

‘In the first six months of 2020, we counted 260 UK companies that had cut their dividends, the single biggest collapse ever.’

McGarry says older investors who have a lower risk appetite were more likely to invest in FTSE 100 stocks before the coronavirus pandemic because until then they had been fairly reliable dividend payers.

But the crisis forced them to start looking for income elsewhere, and many saw mid-sized and smaller companies, falling outside the FTSE 100 universe of firms worth £4billion-plus, as a good place to start.

‘The diversity in small and mid-caps is attractive – technology, healthcare, online gaming, consumer discretionary – and this range is good for portfolio diversification,’ says McGarry.

‘It’s usually easier to grow faster when you are small, so these companies tend to grow faster in percentage terms. And their dividend can grow faster too, assuming the management doesn’t want to divert all their cash to driving future growth.

‘That said, mid and small cap investing is riskier – smaller companies are more likely to fail than larger ones, although financial leverage [borrowing] is often the more important factor.’

Which FTSE 250 companies look poised for a dividend comeback?

Several companies in the FTSE 250 are expected to reinstate their dividend in 2021, before attempting to grow them in 2022, says Simon McGarry of Canaccord Genuity Wealth Management.

He picked out three from the list above for greater scrutiny.

Paragon: ‘For the last 10 years, Paragon has been moving into new areas of lending, such as law firms, personal divorce and development for residential housebuilders.

‘It has a low NIM (net interest margin – the gap between what a bank borrows at and what it lends at) back book rolling into a higher NIM front book, which means that NIM is improving.

‘This makes it one of the few UK banks to have its margins improving, due to the shift away from buy to let.’

Redrow: ‘Housebuilders, which have been among the most resilient UK income stocks since the global financial crisis, feature prominently with Redrow and Bellway appearing.

‘Take Redrow – it has a good management team and a high quality product. There is scope to grow volumes strongly but also to use part of their cash flow to pay dividends. It’s a highly cash generative business with a strong balance sheet.’

Micro focus: ‘Micro Focus has had a torrid few years after its acquisition of HP Enterprise went badly awry and is struggling with debts of more than US$4billion.

‘But the business continues to generate significant amounts of free cash flow despite having a difficult 2020. It also enjoys a large amount of recurring well diversified revenues and high margins and although its debt is high, it is anticipated it will come down quite quickly.’